I: Claude Is the Drug, Cursor Is the Dealer

Coding Tools Are Just One Front in AI’s Supply Chain Wars

There is a rumor floating around tech-twitter that Cursor makes just ten cents for every dollar it spends. Maybe that number is exaggerated but even if it’s directionally correct at some point we are in for a rude awakening in the world of consumer AI apps.

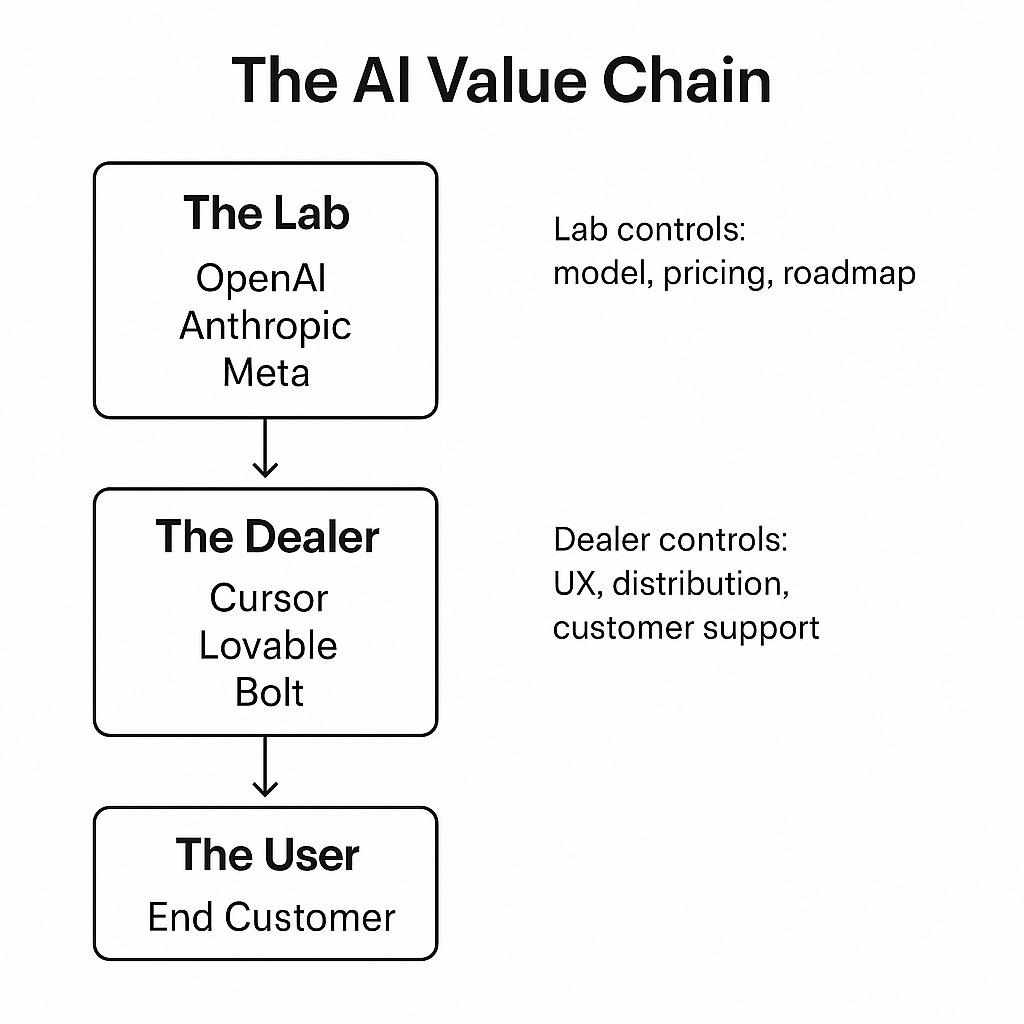

Many of today’s sexiest AI startups are not product companies but rather distribution arms for someone else’s model.

These companies are beloved on Twitter, raise at billion-dollar valuations and build beautiful user experiences. The approaching bubble pop? They don’t own the product and they don’t control the supply chain. They live and die by the labs upstream.

We are witnessing tech’s version of the drug trade: a few powerful labs synthesize the product and startups hustle to get it into users’ hands. Often fronting much of the costs and raising large venture rounds to keep the economics alive.

1. The Lab and the Street

If OpenAI, Anthropic, and Meta are the chemists, then startups like Cursor, Bolt and Lovable are the dealers.

The labs develop the substance: the models.

The startups distribute the substance: the dealers.

These startups:

Wrap the model in UX

Front the inference cost

Serve the customer

Build a fanbase, raise big VC rounds, grow their ARR fast

But over time, the truth sets in: they don’t control the pricing, they don’t control the roadmap, and their supplier keeps shipping your best features natively.

2. Cursor, Lovable, and Bolt

Let’s name names.

Cursor

Raised $900M at a $9B valuation in 2025.

Built a great AI coding IDE with full-codebase context and session memory.

Runs nearly all inference through OpenAI and Anthropic.

Lovable

Raised $150M–$200M at around a $2B valuation.

Offers low-code app generation powered by Claude, with self-hosting, simplified templates and free trials to get user’s hooked.

Bolt

A lightweight app that wraps GPT and Claude in a clean, keyboard-first interface.

Simple UX wrappers on the market.

No proprietary model, no infra, no moat if the labs go direct.

These companies not only have strong branding and ARR that have investors drooling (literally) but they are also growing the market. With big marketing budgets and costs that are funded by venture pricing models these companies are revealing just how big each use case may be.

But there’s a tradeoff. As they grow adoption, they send a clear signal upstream: this is what users want.

And more often than not, the labs take notice. (More on that later.)

What’s to Come

In AI, the story looks quite similar across every new crop of YC startups or venture announcements. What we’ve covered here is just one slice of the market: coding tools. The same dynamics are playing out and will play out in other fast-growing categories: meeting notetakers, AI therapists, creative assistants and beyond.

From here, the path forks.

Path 1: labs go direct and wrappers get cut out.

Illustrated by Foundation Capital’s excellent graphic below:

Path 2: models become commoditized, like generic Advil, and wrappers can win.

I’ll explore both of those futures in upcoming posts. For now, the takeaway is simple: unless you own the model, you’re not the product. You’re just the dealer and the lab always has the purer supply.

🤯